Filing Tax Assessment Appeal in Jersey City

In this post, I will cover a how to for filing a resident’s tax appeal. It’s quite simple. This is not meant to cover all special situations but should cover simple situations if you live in a condo in Jersey City for example. For other situations, review the handbook listed below.

Most importantly – this appeal needs to be in the hands of the folks by Dec 1 2022 otherwise it will be rejected. Therefore, really important to visit the office and hand it over in-person the tax officer said. You could also send it via a certified mail.

Important Links

- Where to get the appeal form for mid-year added/omitted assessment https://www.state.nj.us/treasury/taxation/pdf/other_forms/lpt/adomap.pdf

N/A for mid-year: But if you are filing during the usual time January or Apr for annual tax changes use https://www.hcnj.us/wp-content/uploads/2021/12/a-1-petition-of-appeal.pdf- Comparables are obtained from: https://www.zillow.com/b/20-2nd-st-jersey-city-nj-5XkRmF/

- Appeals handbook: https://secure.njappealonline.com/prodappeals/help/Hudson_InstructionsHandbook.pdf

- If you are filing an online appeal you can do so at http://www.njappealonline.com/prodappealonline/Home.aspx however, this site only works at certain times of the year. For example, in Nov 2022 the site is not accepting Hudson County appeals for some reason.

How to fill the form:

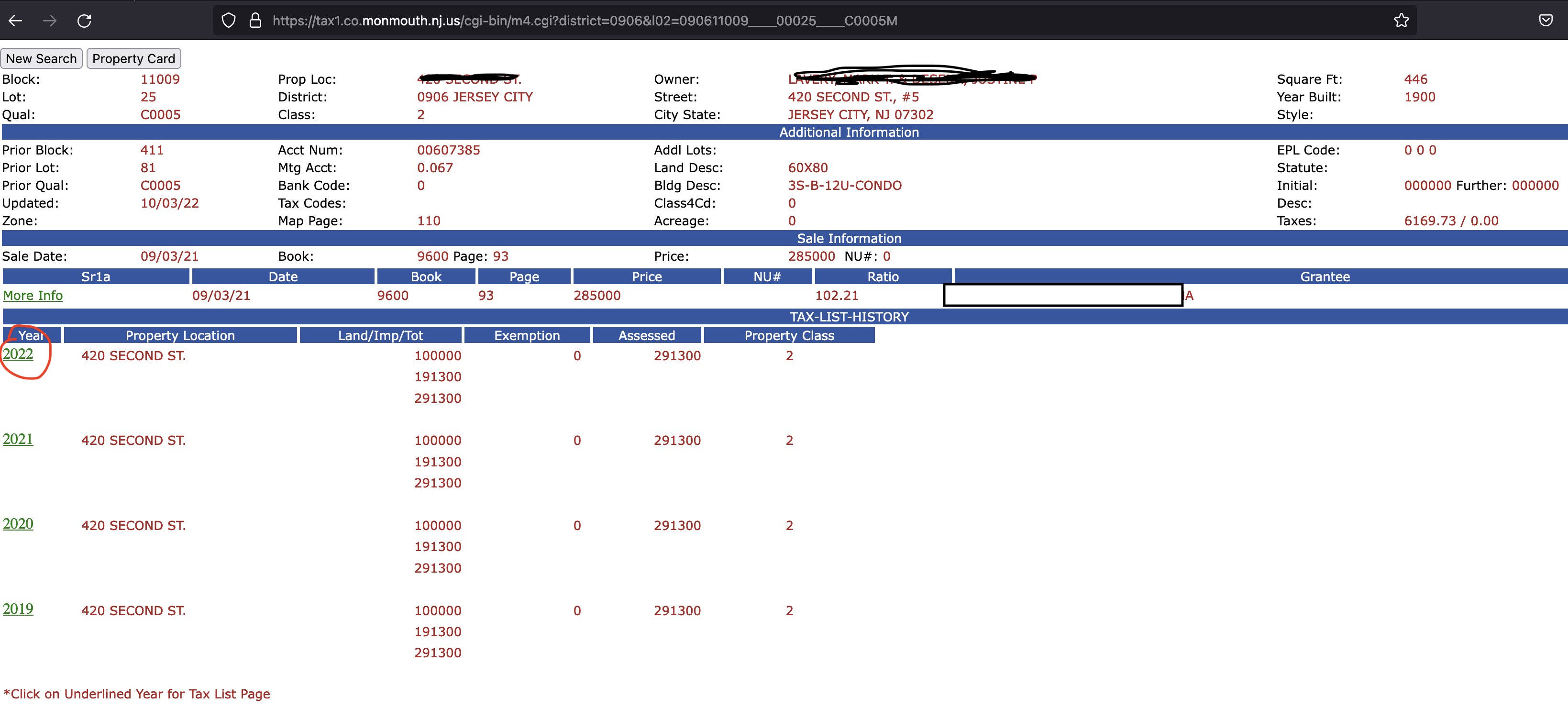

- The total assessed value of your property = land + improvement assessment values. You find this by going to https://tax1.co.monmouth.nj.us/cgi-bin/prc6.cgi?district=0906&ms_user=monm and clicking on the “year” as shown below.

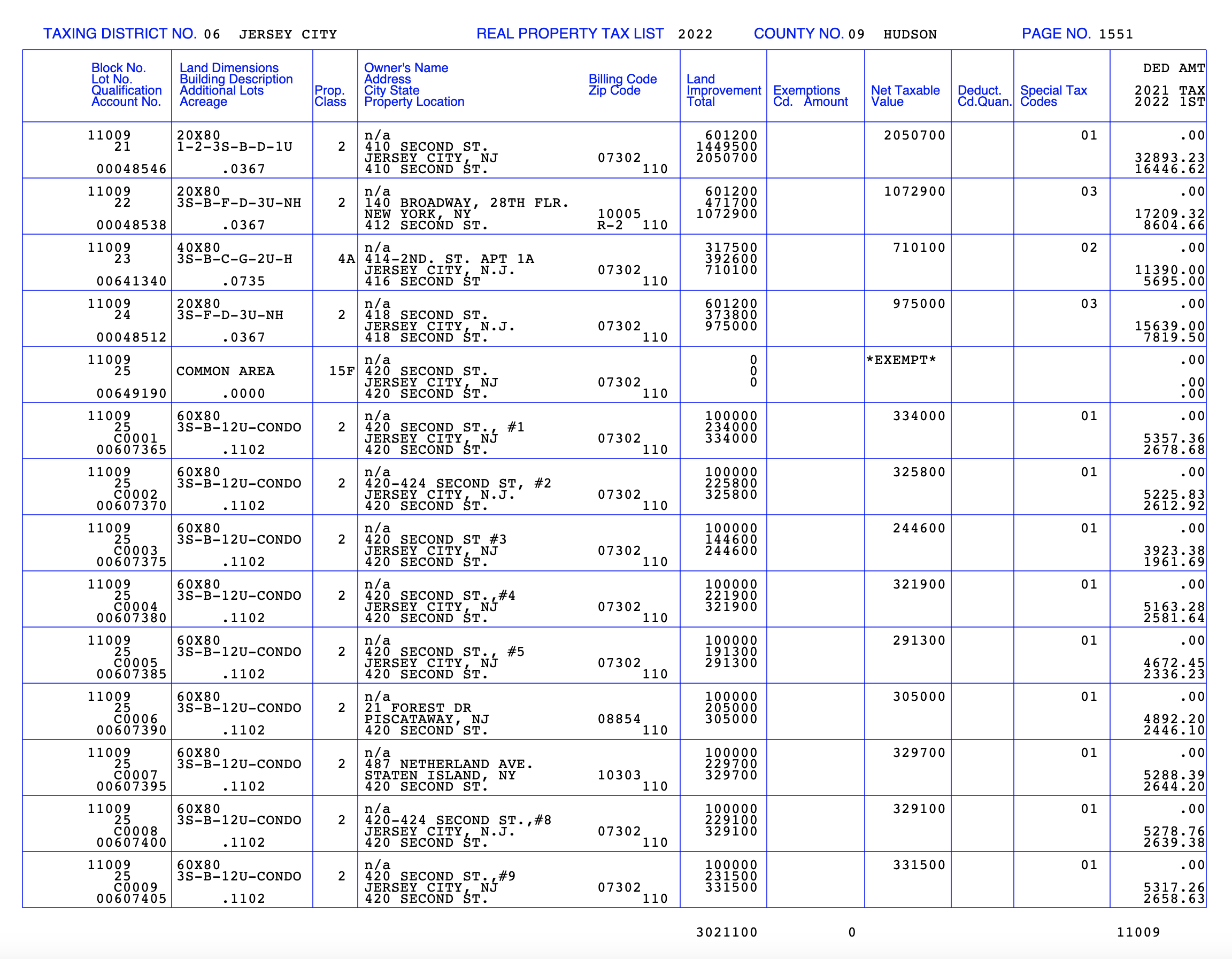

From the following page that pops up find the land and improvement values for your unit (by looking up your property address).

- This is the link for the ratio for Jersey City municipality (max value is 100%) i.e., the cost of the sale price. Minimum value for Common Level Ratio in Jersey City for 2022 is 0.7426 and Max is 1.0. So if your unit value is assessed to be within the maximum and minimum range you do not qualify for an appeal.

This is where you get the Common Level Ratio values from: https://www.state.nj.us/treasury/taxation/pdf/lpt/chap123/2022ch123.pdf . E.g., let’s say your unit value was assessed to be $1mn and comparative sale prices show that the total value of the unit is $950,000 this sale price is not within $1mn/0.7426 and $1mn/(1.0). This means that you qualify for an appeal. So your taxable value would be $950,000*0.8737 (Avg. value of the Common Level Ratio) = $830,015. At a 2.118% tax rate this would come to $17,580. - The is what the fields look like:

Bock / Lot / Qualifier – you get it from your tax bill and also can be obtained from https://tax1.co.monmouth.nj.us/cgi-bin/prc6.cgi?district=0906&ms_user=monm by searching the site via address - Next go to Zillow (https://www.zillow.com/b/20-2nd-st-jersey-city-nj-5XkRmF/) and find the comparable sales for your unit for the pretax year (if you are appealing 2022 assessment, use 2021 sales). Goto https://tax1.co.monmouth.nj.us/cgi-bin/prc6.cgi?district=0906&ms_user=monm and find the sale dates and add that information to the form.

- The prorated fields in the form can be left out because the county knows those values (so I did not fill those out, the county clerk did that for me)

- Sign and date the form

- You need to send one copy each to the following addresses via post or in-person (if the online system does not work).

Hudson County Board of Taxation, Hudson County Plaza, 257 Cornelison Ave Room 303, Jersey City NJ 07302. You also need to send one copy to the city: Office of the City Assessor, 364 Martin Luther King Drive, Jersey City NJ 07305. Phone: 201-547-5131.

Update 12/29/2022:

I did go to the Hudson county court and appealed my decision in person. The city representatives were quite polite and the process was quite smooth – you just show up in the court and either accept or reject the city’s proposal. Once the judgment is reached they mail you the judgment which you can appeal for 45 days. After that the decision is binding for 2 years.